obx sandbar living monthly market update

🎆 Hello, 2026 from the OBX!

Happy New Year! 2026 is here, and the Outer Banks is settling into its quiet, winter rhythm—peaceful beaches, clear skies, and plenty of opportunity ahead.

January is an ideal time to reset, reflect, and plan, especially when it comes to real estate. In this issue, we’re taking a look at how the market closed out its 2025, early trends to watch, and what they could mean if buying or selling is on your radar in the months ahead.

As always, I’m happy to provide a more detailed look at your specific neighborhood or property — feel free to contact me anytime!

-Danielle

Outer Banks Real Estate Market-at-a-Glance for YTD 2025

Sold and Under Contract Analysis

SINGLE FAMILY RESIDENTIAL:

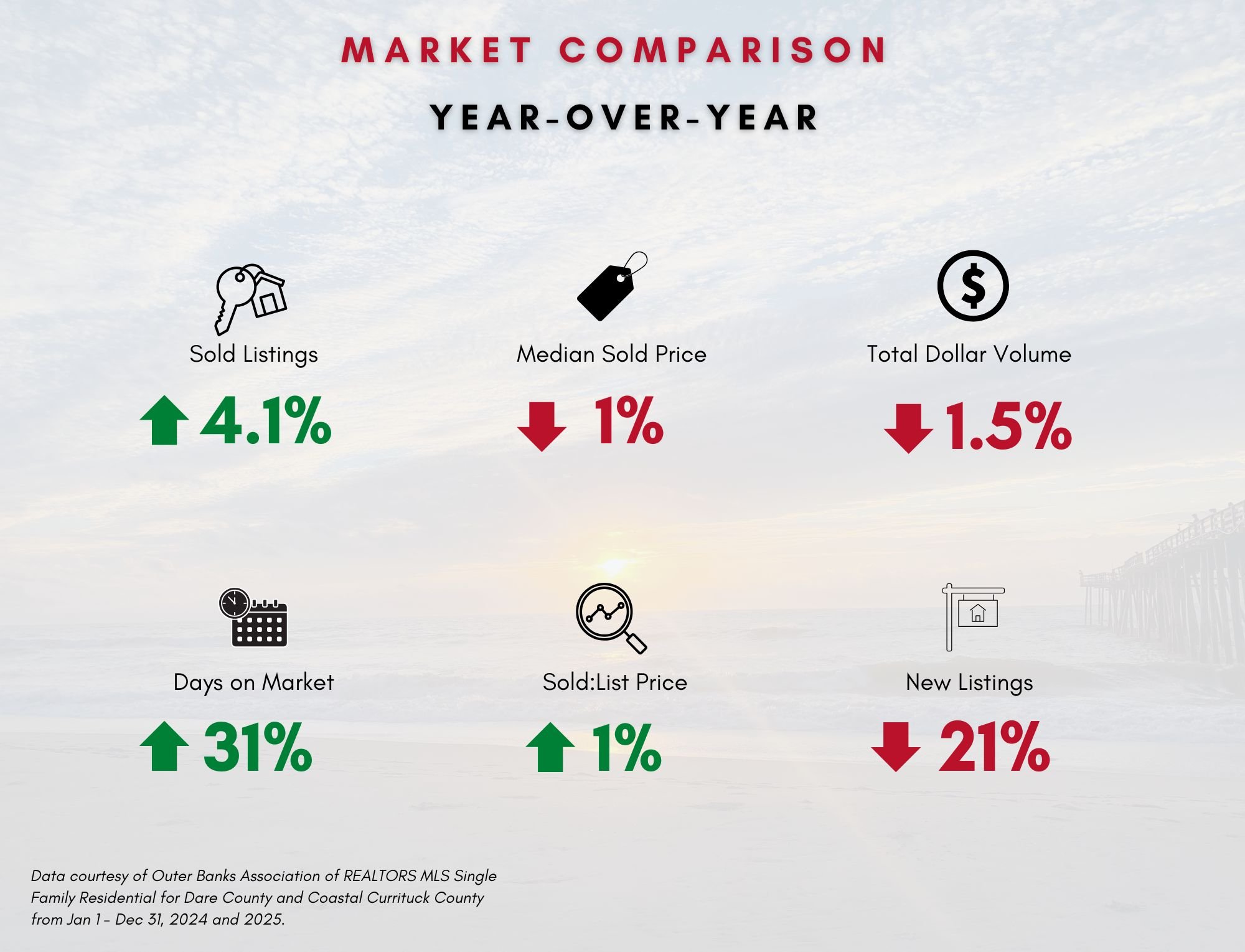

YTD residential sales units are up 4.1% versus YTD 2024

YTD residential sales dollars are down 1.5% vs. YTD 2024

YTD median sale price is $695,000, down 1% vs. YTD 2024 (meaning that half of the properties sold above $695,000 and half sold below that price)

YTD average sale price is $858,975, down 2.5% vs. YTD 2024

December 2025 residential sales units were up 18% versus December 2024

Sales units December ‘25 over November ‘25 were up 26%

New listing inventory for December was down 47.4% versus November

As a comparison, new listings for December ‘25 were down 21% versus December ‘24

December residential sales volume vs. November was up almost 35%

Active listings are down almost 13% versus November

While December’s sold units were up 26% and dollar volume was up almost 35% versus the month prior, the median sold price was actually down almost 9% month over month. You might be asking yourself, “how is total dollar volume up by such a drastic amount when the median sold price is down?” Great question! The answer lies in the fact that there were 4 sales in December 2025 with sold prices over $3,800,000! Those four sales alone accounted for over $15 million in total volume.

Multiple offer situations are fairly flat year-over year; however, disclosed multiple offers for December 2025 were down almost 21% versus November. Multiple offers are not a required disclosure in our MLS, but it will be interesting to see whether this was an isolated event or if multiple offers will continue to trend downward as we head into the new year. As always, multiple offer situations are heavily influenced by positioning in the market from the outset, as well as by area and town, so be sure to watch our monthly stats videos on YouTube for more insight!

As we’ve said before, it’s critical for sellers to price and position your home correctly from the outset. What does that mean? Follow the comparable sales and trends for your specific neighborhood and follow your trusted agent’s guidance on staging and making your home as attractive as possible to buyers. If you think selling is in your future, please don’t hesitate to contact me to discuss your options. While the weather outside might still be frightful, make no mistake - the spring selling season has arrived on the Outer Banks! It’s the perfect time to get ahead of the market if you’re considering selling.

For our buyers, keep in mind that if you’re waiting for a price reduction on your dream home, there’s a good chance that others are, too, and you might still wind up in multiple offers on a home that’s been on the market a while!

Now, let's look at month-over-month:

Median sale price for all Residential property sold in the month of December was $635,000, down 9% versus November ‘25.

December 2025's median sale price was down 6.3% versus December 2024.

December ‘25 vs. December ‘24, residential properties sold almost 40% slower (if you’ll recall, we noted a brief reversal of this trend in our last market update — as suspected, the lower days on market of the month prior seems to have been an anomaly).

We’re seeing a reduction in cash buyers (down 3.3%) and disclosed multiple offers (down around 1%) year over year (keep in mind that multiple offers are not a required disclosure in our MLS).

RESIDENTIAL LOTS AND LAND:

YTD residential land sales units are down 9% versus YTD 2024.

YTD residential land sales dollars are down 6% versus YTD 2024.

YTD residential land median sold price is $154,500, down 3% versus YTD 2024.

December residential land sales units were down 26% compared to December ‘24.

December residential land sales units were down 26% versus November ‘25.

December residential land sales dollars were down 42% versus December ‘24.

December residential land sales dollars were down 50% versus November ‘25.

inventory analysis

New listing inventory for December 2025 was down 21% versus December 2024 and down 47.4% versus December’s new listings.

Drilling down, only 71 new listings hit the market in December 2025, with 27% of those properties already sold or under contract.

Average days on market for these is 1; median days on market is 1 (can’t get any faster than that!).

3 of those listings have already closed as of 12/31; of those, one was a cash purchase and one disclosed multiple offers (disclosure of multiple offers is not required by our MLS).

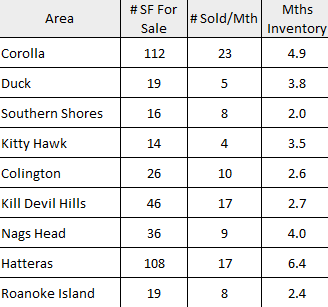

See the chart below for the full breakdown by area…

Inventory Analysis by Area YTD 2025

If you’d like to get more hyper-local with your neighborhood or area, please feel free to contact me!

days on market and distressed data analysis

Average days on market for SOLD residential properties in December was 78, selling 32% slower than November’s average of 59 days.

While November saw a reversal in the ongoing trend of longer days on market year-over-year, that reversal proved to be brief, with December showing lengthening both month-over-month and year-over-year.

The average home sold 39% slower in December 2025 (78 days) versus December 2024 (56 days).

The Median days on market in December was 39, meaning that half of the sold units did so in 39 days or less.

Year over year, the average DOM for properties sold in 2025 is 71 (up from 54 days YTD 2024), meaning that the average property sold 31% slower than one year ago.

Average days on market for all current ACTIVE residential listings is 113 days (down 5% versus November)

Month-over-month, the average days on market for Under Contract properties is 77 days (down 1.7% versus 78 days in November).

27% of properties listed in December have already gone under contract or sold with an average days on market of 1.

It still rings true that homes that are priced consistent with their condition and/or are located in high demand areas per the chart above are still moving quickly and with multiple offers.

For distressed sales (short sales and/or bank-owned properties), there were 0 sold units in December ‘25 (flat to December 2024). There were 2 active distressed units as of December 31, 2025.

Year-Over-Year Market Comparison

pricing analysis

Residential Median Sale Price for YTD 2025 was $695,000, which was down 1% versus the year prior.

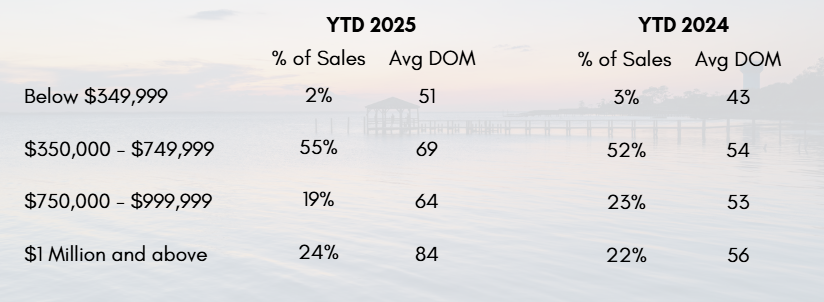

You’ll find a breakdown by price point below:

Year-over-Year Sales Comparison by Price Point

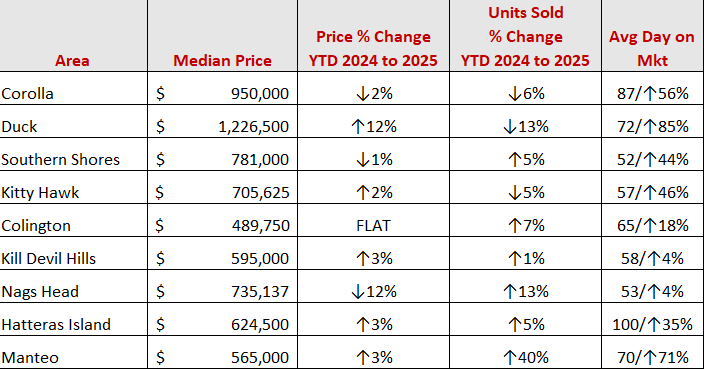

area data at-a-glance

*All market data presented is courtesy of the Outer Banks Association of REALTORS MLS Single Family Residential, Jan 1 - Dec 31, 2024 and 2025.